Market Outlook

May 09, 2018

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open negative tracking global indices and SGX Nifty.

BSE Sensex

0.0

8

35,216

U.S. stocks saw a negative bias throughout much of the previous trading session.

Nifty

0.0

2

10,718

The lackluster close by the major averages came following President Donald Trump's

Mid Cap

(0.1)

(17)

16,635

announcement of his controversial but widely expected decision to withdraw from an

Small Cap

0.1

18

18,109

international agreement intended to limit Iran's nuclear program. The Dow Jones

rose to 24,360 and the Nasdaq was flat at 0.0% percent to 7,267.

Bankex

1.3

382

29,365

U.K. shares held steady on Tuesday, with a weaker pound and deal-making news

Global Indices

Chg (%)

(Pts)

(Close)

offering some support ahead of an announcement by U.S. President Donald Trump

on whether he would withdraw from a landmark nuclear deal with Iran.The FTSE

Dow Jones

0.0

3

24,360

100 was flat at 7,566.

Nasdaq

0.0

2

7,267

FTSE

(0.0)

(1)

7,566

On domestic front, Indian shares ended largely unchanged on Tuesday, tracking

mixed global cues as investors awaited an announcement by U.S. President Donald

Nikkei

0.2

42

22,509

Trump on whether he would withdraw from a landmark nuclear deal with Iran. The

Hang Seng

1.4

409

30,403

BSE Sensex ended on a flat 0.0% at 35,216.

Shanghai Com

0.8

25

3,161

News Analysis

Advances / Declines

BSE

NSE

India opens biggest CGD round, expects investments to the tune of Rs 800bn

Advances

1,167

770

Detailed analysis on Pg2

Declines

1,532

1,014

Investor’s Ready Reckoner

Unchanged

129

73

Key Domestic & Global Indicators

Volumes (` Cr)

Stock Watch: Latest investment recommendations on 150+ stocks

4,571

Refer Pg5 onwards

BSE

NSE

34,184

Top Picks

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

Net Inflows (` Cr)

Net

Mtd

Ytd

Blue Star

Capital Goods Accumulate

790

867

9.7

Dewan Housing Finance

Financials

Buy

623

720

15.6

FII

(602)

(2,617)

4,780

Century Plyboards

Forest Product

Buy

308

400

29.8

*MFs

294

534

46,287

Navkar Corporation

Others

Buy

164

265

61.5

KEI Industries

Capital Goods Accumulate

445

485

8.9

Top Gainers

Price (`)

Chg (%)

More Top Picks on Pg4

ICICIBANK

309

6.9

Key Upcoming Events

INDIANB

341

6.3

Previous

Consensus

Date

Region

Event Description

ReadingExpectations

GRUH

707

5.6

May 09, 2018 US

Producer Price Index (mom)

0.20

INOXLEISUR

298

5.5

May 10, 2018 US

Consumer price index (mom)

(0.10)

0.30

BEML

1,117

4.9

May 10, 2018 US

Initial Jobless claims

211.00

218.00

May 10, 2018 UK

Industrial Production (YoY)

2.20

3.10

Top Losers

Price (`)

Chg (%)

May 10, 2018 India

Industrial Production YoY

7.10

More Events on Pg7

PCJEWELLER

203

-15.8

PNBHOUSING

1264

-8.1

TRIDENT

64

-6.6

SYNGENE

619

-3.4

SUZLON

10

-3.4

As on May 08, 2018

Market Outlook

May 09, 2018

News Analysis

India opens biggest CGD round, expects investments to the tune of Rs

800bn

The government has launched its biggest city gas licensing round on Tuesday

offering 86 geographical areas covering 174 districts, that may see an investment

to the tune of around Rs 600-800 billion. In each of these 86 areas on offer,

covering 22 states, the government expects an approximate investment of Rs 7-10

billion in a span of eight years. The bidders will get permits to sell compressed

natural gas (CNG) and piped cooking gas in the areas under offer. Through these

measures, the government expects to raise the share of natural gas in India's

energy mix from 6 per cent to 15 per cent. Prior to this, only 91 geographical

areas were covered in the previous eight rounds.

The current round will be covering 29 per cent of India's population and 24 per

cent of the country's geographical area. The last date of submission of bids is July

10. "By October this year, contracts for the areas will be awarded and by April

2019, gas distribution is likely to start," said D K Sarraf, chairman of PNGRB.

Economic and Political News

India opens biggest CGD round, expects investments to the tune of Rs 800bn

Karnataka farm sector gets 6 hours of power daily, least in India

Govt mulls action against bank officials whose names cropped up in frauds

Trai mulls fine on telecom operators not meeting new quality norms for Q3

Corporate News

Telecom dept to examine proposal for sale of Tata Teleservices’ enterprise

business

Dalmia Bharat moves SC on NCLT's Binani Cement order, hearing on May

10

Bank of India starts proceedings to recover Rs 2bn stuck in PNB scam

SBI General Insurance's net profit swells 150% to Rs 4 bn in FY18

Market Outlook

May 09, 2018

Quarterly Bloomberg Brokers Consensus Estimate

Eicher Motors Ltd - May 09, 2018

Particulars ( ` cr)

4QFY18E

4QFY17

y-o-y (%)

3QFY18

q-o-q (%)

Sales

2,508

1,888

32.8

2,269

10.5

EBIDTA

800

584

36.9

707

13.2

%

31.8

30.9

31.2

PAT

630

459

37.3

520

21.2

Federal Bank Ltd - May 09, 2018

Particulars ( ` cr)

4QFY18E

4QFY17

y-o-y (%)

3QFY18

q-o-q (%)

PAT

271

256

5.8

260

3.8

Titan Ltd - May 10, 2018

Particulars ( ` cr)

4QFY18E

4QFY17

y-o-y (%)

3QFY18

q-o-q (%)

Sales

4,005

3,257

22.9

4,274

(6.3)

EBIDTA

333

253

31.6

422

(21.1)

%

8.3

7.2

9.9

PAT

250

178

40.4

281

(11.1)

Asian Paints Ltd - May 10, 2018

Particulars ( ` cr)

4QFY18E

4QFY17

y-o-y (%)

3QFY18

q-o-q (%)

Sales

4,420

3,908

13.1

4,260

3.8

EBIDTA

834

707

17.9

891

(6.4)

%

18.9

18.1

20.9

PAT

541

479

12.9

567

(4.6)

Market Outlook

May 09, 2018

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its

leadership in acute therapeutic segment. Alkem

Alkem Laboratories

23,913

2,000

2,441

22.1

expects to launch more products in USA, which

bodes for its international business.

Favorable outlook for the AC industry to augur well

for Cooling products business which is out pacing

Blue Star

7,588

790

867

9.7

the market growth. EMPPAC division's profitability

to improve once operating environment turns

around.

With a focus on the low and medium income (LMI)

consumer segment, the company has increased its

Dewan Housing Finance

19,539

623

720

15.6

presence in tier-II & III cities where the growth

opportunity is immense.

Well capitalized with CAR of 18.1% which gives

sufficient room to grow asset base. Faster resolution

ICICI Bank

1,98,808

309

416

34.5

of NPA would reduce provision cost, which would

help to report better ROE.

High order book execution in EPC segment, rising

KEI Industries

3,490

445

485

8.9

B2C sales and higher exports to boost the revenues

and profitability

Expected to benefit from the lower capex

Music Broadcast Limited

2,081

365

475

30.3

requirement and 15 year long radio broadcast

licensing.

Massive capacity expansion along with rail

Navkar Corporation

2,469

164

265

61.5

advantage at ICD as well CFS augur well for the

company

Strong brands and distribution network would boost

Siyaram Silk Mills

3,059

653

851

30.4

growth going ahead. Stock currently trades at an

inexpensive valuation.

Market leadership in Hindi news genre and no. 2

viewership ranking in English news genre, exit from

TV Today Network

2,732

458

603

31.7

the radio business, and anticipated growth in ad

spends by corporate to benefit the stock.

GST regime and the Gujarat plant are expected to

Maruti

2,65,080

8,775

10,619

21.0

improve the company’s sales volume and margins,

respectively.

We expect loan book to grow at 24.3% over next

GIC Housing

2,266

421

655

55.7

two year; change in borrowing mix will help in NIM

improvement

We expect CPIL to report net Revenue/PAT CAGR of

~17%/16% over FY2017-20E mainly due to

Century Plyboards

6,848

308

400

29.8

healthy growth in plywood & lamination business,

forayed into MDF & Particle boards on back of

strong brand & distribution network.

We expect sales/PAT to grow at 13.5%/20% over

LT Foods

2,883

90

128

42.0

next two years on the back of strong distribution

network & addition of new products in portfolio.

Third largest brand play in luggage segment

Increased product offerings and improving

Safari Industries

1,397

628

750

19.4

distribution network is leading to strong growth in

business. Likely to post robust growth for next 3-4

years

We expect HSIL to report PAT CAGR of ~15% over

FY2017-20E owing to better improvement in

HSIL Ltd

2,757

381

510

33.8

operating margin due price hike in container glass

segment, turnaround in consumer business.

Source: Company, Angel Research

Market Outlook

May 09, 2018

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

We expect financialisation of savings and

Aditya Birla Capital

35,272

160

218

36.0

increasing penetration in Insurance & Mutual fund

would ensure steady growth.

One of the leading Indian dairy products

companies in India created strong brands in dairy

products. Rising revenue share of high-margin

Parag Milk Foods

2,677

318

335

5.2

Value Added Products and reduction in interest cost

is likely to boost margins and earnings in next few

years.

We expect MCL to report net revenue CAGR of

~15% to ~`450cr over FY2018-20E mainly due to

strong growth in online matchmaking & marriage

Matrimony.com Ltd

1,930

813

984

21.1

related services. On the bottom-line front, we

expect a CAGR of ~28% to `82cr over the same

period on the back margin improvement.

HDFC Bank maintained its steady growth in the

4QFY18. The bank’s net profit grew by 20.3%.

Steady growth in interest income and other income

HDFC Bank

5,10,721

1,967

2,315

17.7

aided PAT growth. The Strong liability franchise

and healthy capitalisation provides strong earning

visibility. At the current market price, the bank is

trading at 3.2x FY20E ABV.

HDFC Bank maintained its steady growth in the

4QFY18. The bank’s net profit grew by 20.3%.

Steady growth in interest income and other income

HDFC Bank

5,10,721

1,967

2,315

17.7

aided PAT growth. The Strong liability franchise

and healthy capitalisation provides strong earning

visibility. At the current market price, the bank is

trading at 3.2x FY20E ABV.

Source: Company, Angel Research

Market Outlook

May 09, 2018

Fundamental Call

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth trajectory

CCL Products

4,117

309

360

16.3

over FY18-20 backed by capacity expansion and

new geographical foray

We forecast Nilkamal to report top-line CAGR of

~9% to `2,635cr over FY17-20E on the back of

Nilkamal

2,508

1,681

2,178

29.6

healthy demand growth in plastic division. On the

bottom-line front, we estimate

~10% CAGR to

`162cr owing to improvement in volumes.

The prism has diversified exposure in the different

segment such as Cement, Tile & ready mix concrete.

Prism Cement

5,969

119

160

34.5

Thus we believe, PCL is in the right place to capture

ongoing government spending on affordable

housing and infrastructure projects.

Elantas Beck India is the Indian market leader in

liquid insulation segment used in electrical

equipments like motors, transformers etc. It derives

Elantas Beck India Ltd

1,809

2,282

2,500

9.5

demand from several industries which are expected

to register 10%+ CAGR in demand in the coming

years.

Greenply Industries Ltd (GIL) manufactures plywood

& allied products and medium density fibreboards

(MDF). GIL to report net revenue CAGR of ~14% to

Greenply Industries

3,759

307

395

28.9

~`2,478cr over FY2017-20E mainly due to healthy

growth in plywood & lamination business on the

back of strong brand and distribution network

GMM Pfaudler Limited (GMM) is the Indian market

leader in glass-lined (GL) steel equipment. GMM is

expected to cross CAGR 15%+ in revenue over the

GMM Pfaudler Ltd

1,215

831

880

5.9

next few years mainly led by uptick in demand from

user industries and it is also expecting to increase its

share of non-GL business to 50% by 2020.

L&T Fin’s new management is on track to achieve

L&T Finance Holding

36,072

181

210

16.2

ROE of 18% by 2020 and recent capital infusion of

`3000cr would support advance growth.

Market Outlook

May 09, 2018

Key Upcoming Events

Result Calendar

Date

Company

May 09, 2018

Federal Bank, Jindal Steel

May 10, 2018

Apollo Tyres, Union Bank, Indian Bank, Nestle, Asian Paints, Mphasis, ITD Cementation, Quick Heal

Source: Bloomberg, Angel Research

Global economic events release calendar

Bloomberg Data

Date

Time

Country

Event Description

Unit

Period

Last Reported

Estimated

May 09, 2018

US

Producer Price Index (mom)

% Change

Apr

0.20

May 10, 2018

6:00 PMUS

Consumer price index (mom)

% Change

Apr

(0.10)

0.30

6:00 PMUS

Initial Jobless claims

Thousands

May 5

211.00

218.00

2:00 PMUK

Industrial Production (YoY)

% Change

Mar

2.20

3.10

5:30 PMIndia

Industrial Production YoY

% Change

Mar

7.10

7:00 AMChina

Consumer Price Index (YoY)

% Change

Apr

2.10

1.90

May 11, 2018

4:30 PMUK

BOE Announces rates

% Ratio

May 10

0.50

0.50

May 14, 2018

12:00 PMIndia

Monthly Wholesale Prices YoY%

% Change

Apr

2.47

May 15, 2018

2:30 PMEuro Zone Euro-Zone GDP s.a. (QoQ)

% Change

1Q P

0.40

2:00 PMUK

Jobless claims change

% Change

Apr

11.60

7:30 AMChina

Industrial Production (YoY)

% Change

Apr

6.00

6.40

India

Imports YoY%

% Change

Apr

7.15

India

Exports YoY%

% Change

Apr

(0.66)

11:30 AMGermany GDP nsa (YoY)

% Change

1Q P

2.30

May 16, 2018

2:30 PMEuro Zone Euro-Zone CPI (YoY)

%

Apr F

1.20

Source: Bloomberg, Angel Research

Market Outlook

May 09, 2018

Macro watch

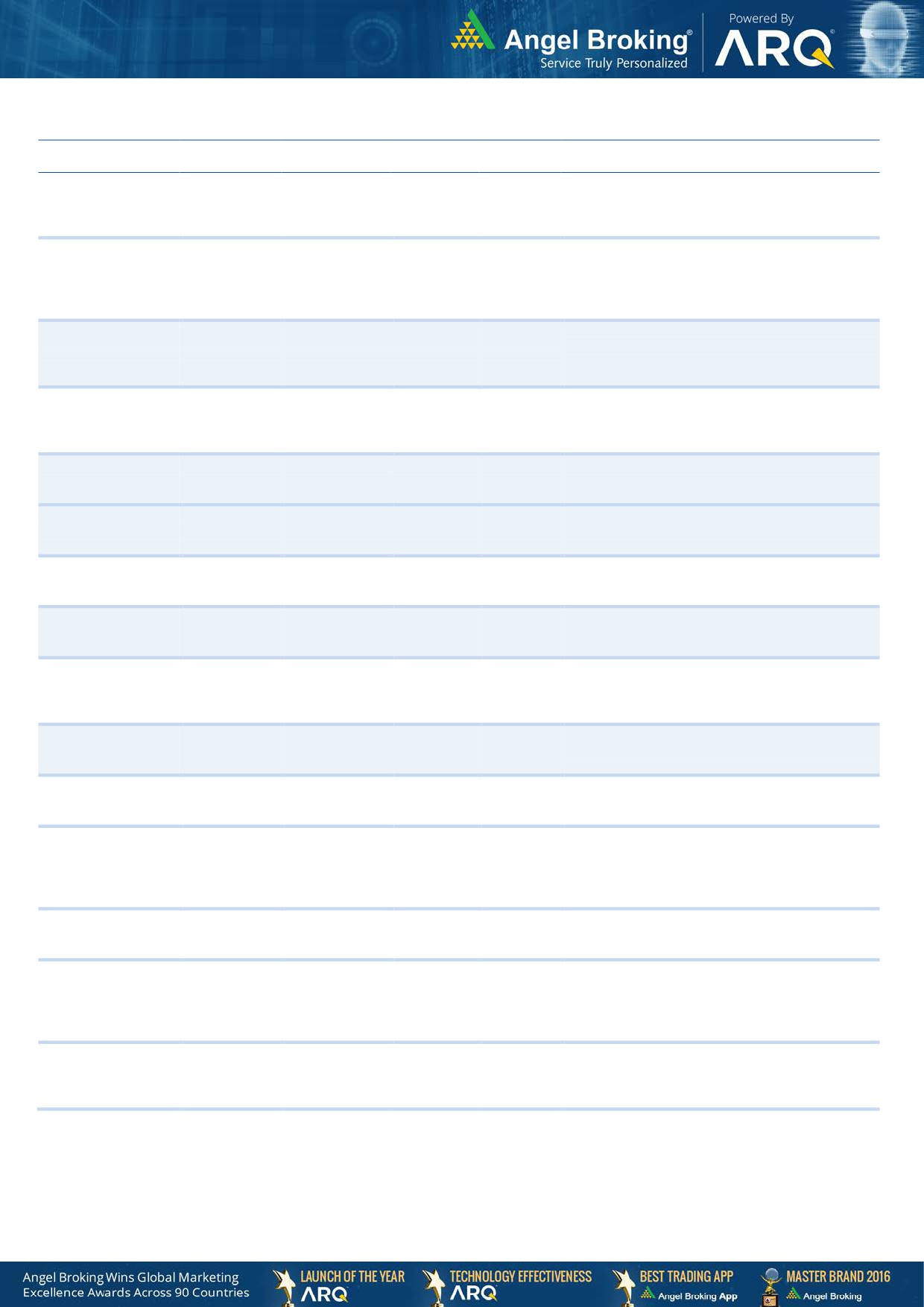

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

8.5

10.0

9.0

9.1

7.4

9.0

8.0

7.1

7.1

8.0

8.1

7.0

7.6

7.6

8.0

7.3

7.2

7.2

6.0

6.8

4.8

7.0

6.5

5.0

4.1

6.1

5.7

4.0

3.2

6.0

2.9

3.0

1.8

5.0

2.0

1.0

4.0

1.0

-

3.0

(1.0)

(0.3)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

6.0

54.0

5.2

5.1

4.9

52.0

5.0

4.4

4.3

50.0

4.0

3.6

3.3

3.3

3.0

48.0

3.0

2.4

2.2

46.0

2.0

1.5

44.0

1.0

42.0

40.0

-

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Source: MOSPI, Angel Research

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

60.0

6.50

50.0

6.00

40.0

5.50

30.0

5.00

20.0

4.50

10.0

4.00

0.0

3.50

(10.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

May 09, 2018

Global watch

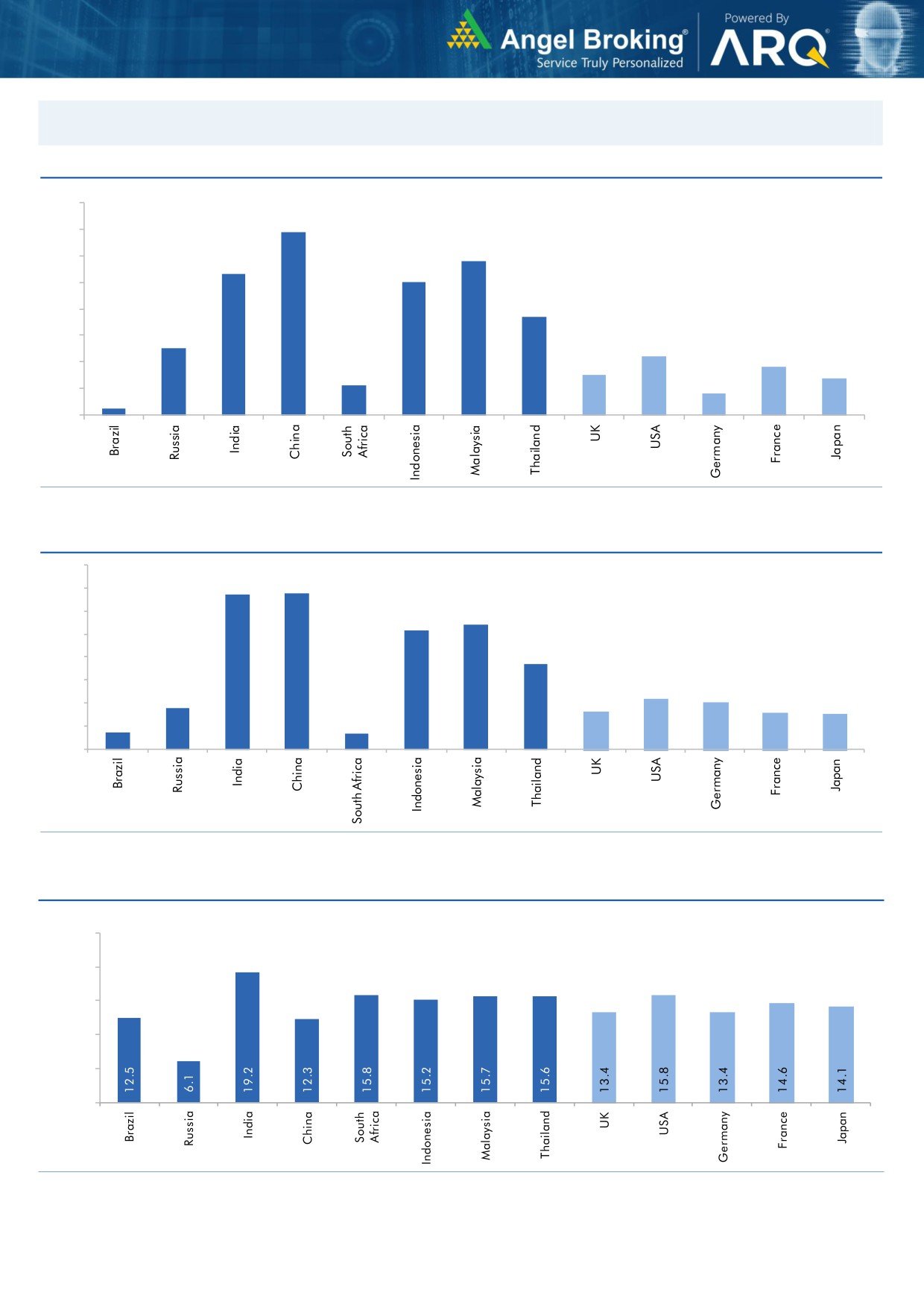

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

7.0

5.8

6.0

5.3

5.0

5.0

1.1

3.7

4.0

2.5

3.0

2.2

1.8

2.0

1.5

1.4

0.8

1.0

0.3

-

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

6.7

6.8

7.0

6.0

5.4

5.2

5.0

3.7

4.0

3.0

1.8

2.2

2.0

1.7

1.6

2.0

0.7

1.5

0.7

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

25.0

20.0

15.0

10.0

5.0

-

Source: IMF, Angel Research

Market Outlook

May 09, 2018

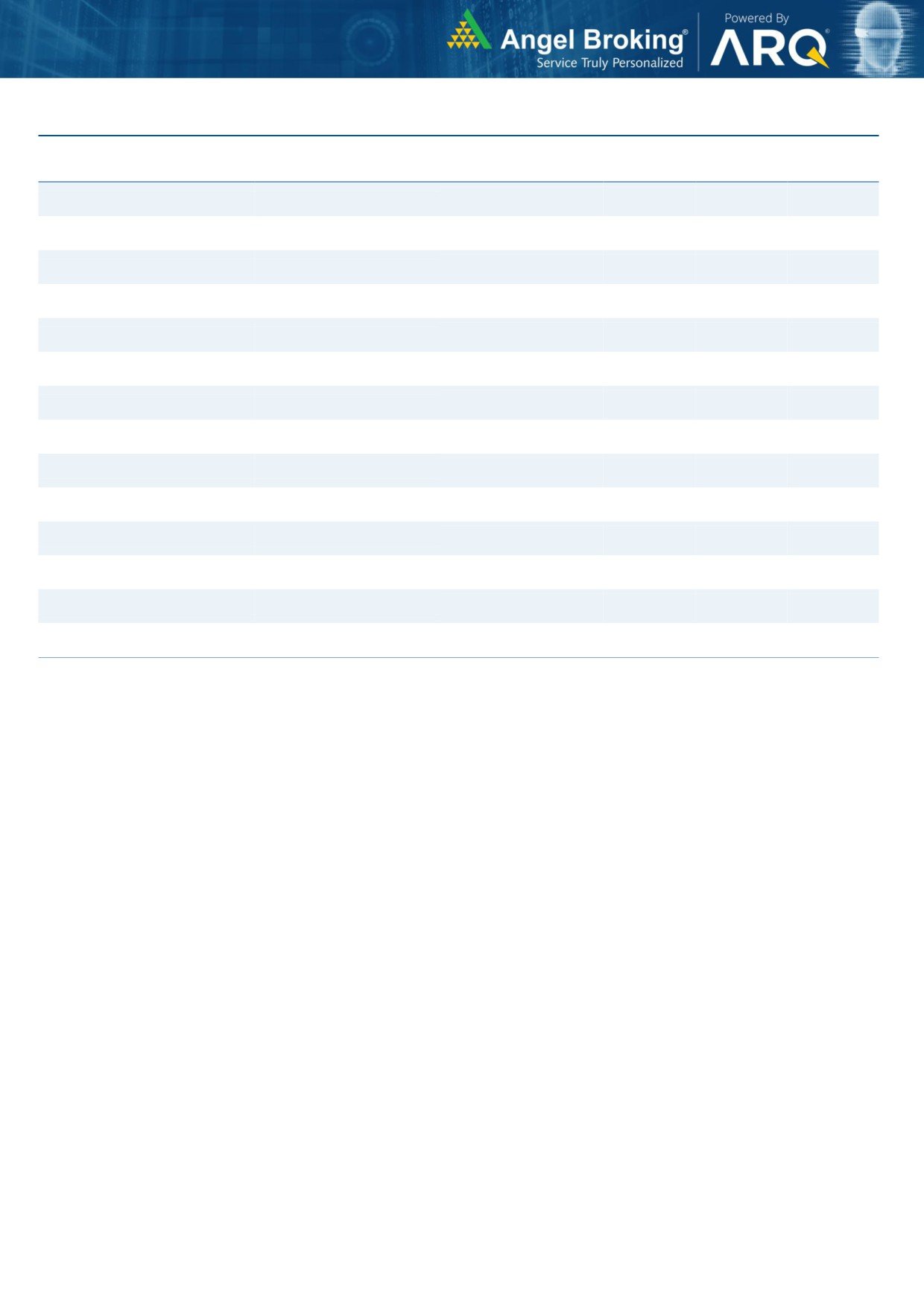

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

82,956

(2.6)

(3.0)

24.3

Russia

Micex

4,491

1.4

7.1

11.4

India

Nifty

10,718

3.8

(2.8)

14.5

China

Shanghai Composite

3,161

0.5

(11.4)

0.0

South Africa

Top 40

51,003

6.1

(3.1)

8.5

Mexico

Mexbol

46,720

(2.6)

(7.4)

(5.6)

Indonesia

LQ45

921

(9.0)

(17.1)

(2.5)

Malaysia

KLCI

1,847

0.6

(0.4)

4.4

Thailand

SET 50

1,161

(0.2)

(2.4)

17.0

USA

Dow Jones

24,360

1.8

0.1

16.1

UK

FTSE

7,567

5.1

1.6

2.4

Japan

Nikkei

22,509

5.7

(2.6)

16.7

Germany

DAX

12,912

4.9

1.0

1.3

France

CAC

5,522

4.6

2.9

2.2

Source: Bloomberg, Angel Research 68in4

Market Outlook

May 09, 2018

Exhibit 7: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Current Status

02-05-2018

Top Picks

HDFC Bank

Open

20-04-2018

Top Picks

Matrimony.com Ltd

Open

16-04-2018

Top Picks

Parag Milk Foods Limited

Open

06-04-2018

Fundamental

GMM Pfaudler Limited

Open

07-03-2018

Fundamental

Ashok Leyland Ltd

Closed (26/04/2018)

03-03-2018

Fundamental

Greenply Industries

Open

21-02-2018

Top Picks

Safari Industries

Open

16-02-2018

Top Picks

HSIL Ltd

Open

07-02-2018

Fundamental

Elantas Beck India Ltd.

Open

01-02-2018

Top Picks

ICICI Bank

Open

01-02-2018

Top Picks

Aditya Birla Capital

Open

04-01-2018

Fundamental

CCL Products

Open

03-01-2018

Fundamental

Nilkamal Ltd

Open

01-01-2018

Fundamental

Capital First Ltd

Closed (15/01/2018)

30-12-2017

Fundamental

Shreyans Industries Ltd

Closed

21-12-2017

Fundamental

Prism Cement Ltd

Open

18-12-2017

Fundamental

Menon Bearings Limited

Closed (17/01/2018)

14-12-2017

Top Picks

Ruchira Papers Ltd.

Closed (09/02/2018)

28-11-2017

Top Picks

Century Plyboards India

Open

06-11-2017

Top Picks

LT Foods

Open

16-10-2017

Fundamental

Endurance Technologies Ltd

Closed (01/12/2017)

11-Sep-17

Top Picks

GIC Housing

Open

20-07-2017

Top Picks

Music Broadcast Limited

Open

07-07-2017

Fundamental

L&T Finance Holdings Ltd

Closed (28/8/2017)

06-07-2017

Fundamental

Syngene International

Closed (1/3/2018)

05-07-2017

Top Picks

Maruti

Open

03-01-2017

Top Picks

Alkem Lab

Open

30-12-2016

Top Picks

KEI Industries

Open

04-08-2016

Top Picks

TV Today Network

Open

05-04-2016

Top Picks

DHFL

Open

05-01-2016

Top Picks

Navkar Corporation

Open

08-12-2015

Top Picks

Blue Star

Open

06-11-2015

Top Picks

Siyaram Silk Mills

Open

Source: Company, Angel Research

Market Outlook

May 09, 2018

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited,Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.